'Average In' to 'Unloved' Stocks, Economic Uncertainty Visual, Druck says Recession in 2023, Home Heating Costs Rising, Income Needed to Buy House Doubles, $1.3M NFT Backed Loan

'Average In' to What’s Out-Of-Favor and Unloved Now

Consider the various narratives floating atop the markets :

"A friend of mine in the business, Charles Gave of all things a really good French economist. Hard to imagine, but really good French economist, likes to talk about the media and the markets in a context of what are these bastards trying to distract me from. I love that way of framing it because the media focuses on narratives. Narratives set prices for assets. Changes in the narratives, move asset prices. So it’s often wonderful to ask what’s the dominant narrative today and will it still matter in five years? If it’s not going to matter in five years, then ask the question, which way will this have moved markets and bet against it."

Investigate the effects of those narratives on businesses and economic sectors:

"...one issue is to ask the question, what is popular and hot now and avoid it. What is out of favor and unloved now? Average in, if you’re averaging in to what’s unloved, one of two things will happen. It’s a value trap and it’s on its way to zero. In which case, if you’re slowly averaging in, you’ll have lost a bit of money. Or it’s a bargain. In which case, if you’re averaging in at the bottom when it turns you’ll have your maximum exposure."

(via The Acquirer's Multiple)

More:

- Morningstar: When The Chips Are Down, Active Investing Falters (Validea)

- Porsche shares rise in landmark Frankfurt IPO (CNBC)

- Succeeding in Venture Capital is Mostly About Knowing What to Buy. When To Sell Matters Also. (Hunter Walk)

- Sacrifice now to create wealth long after the recession (DataDrivenInvestor)

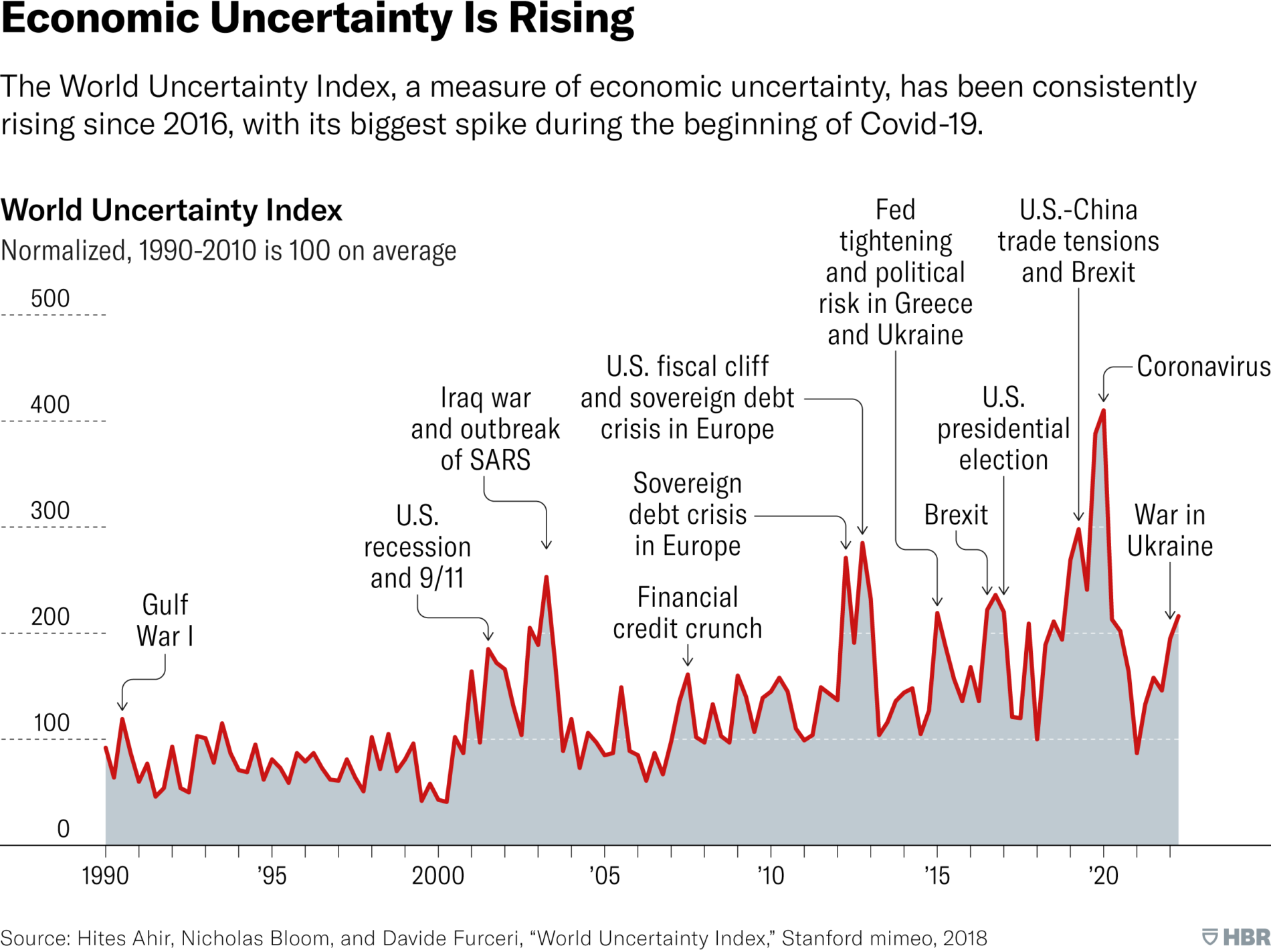

Visualizing the Rise of Global Economic Uncertainty

"Researchers have documented a rise in economic uncertainty in recent years, using text-based measures that track descriptions of economic conditions by the Economist Intelligence Unit. Not only does that work show that uncertainty is rising, it points to five crises that are driving it — including, most recently, the invasion of Ukraine."

Details @ Harvard Business Review

Stanley Druckenmiller says he'd be 'stunned' if recession doesn't happen in 2023

Duquesne Family Office Chairman & CEO Stanley Druckenmiller speaks with CNBC’s Joe Kernen at the CNBC Delivering Alpha Conference.

Read the full interview transcript at CNBC

More:

- Final GDP reading shows U.S. economy shrank 0.6% in spring, cementing start of recession (Fox Business)

- It Starts With Inflation (Ray Dalio)

- Recession Signal: Money-Supply Growth Drops to 3-yr Low in Aug. (Mises)

- Weekly Initial Unemployment Claims decrease to 193,000 (Calculated Risk)

- Pound slips again after rallying due to BoE intervention (The Independent)

- Searches for "Real Estate Market Crash" Highest in History (ZeroHedge)

- How Inflation Works: An Illustrated Guide (Finmasters)

- Big Government is Back With Massive State Interventions (Bloomberg)

- Did The Global Pivot Back To QE Just Begin? (QTR)

Treasury Department Moves Forward With Database on Corporate Ownership

At least 32 million small U.S. businesses will now be required to provide the government with owners' personal information and "others who benefit from them." The new regulation, finalized Thursday, includes the creation of a database to store these details for ownership transparency and prevent concealment of unlawfully obtained assets. (AP)

More:

- Meta to Cut Headcount for First Time, Slash Budgets (Bloomberg)

- Google shutting down Stadia streaming game service in 2023 (Android Police)

- Macy’s Launches Online Marketplace for Third-Party Sellers (Daily Upside)

- Chevron sells global HQ, pares back in California amid Texas expansion (WSJ)

- Bill Gurley: Now might be 'as good a time as you've had in a decade' to build a company from scratch (Business Insider)

- Toyota’s CEO Says EV Adoption Will Take Longer Than Expected (Bloomberg)

- Peloton will sell products at Dick’s Sporting Goods in first brick-and-mortar partnership (CNBC)

- Amazon Raises Hourly Wages at Cost of Almost $1 Billion a Year (Bloomberg)

US Home Heating Costs Set To Surge 17% This Winter

The National Energy Assistance Directors Association (NEADA) expects the average U.S. household heating bill to rise 17.2% this winter compared to last year. In dollar terms, they predict heating bills to increase from $1,025 to $1,202. Energy costs for households already increased last winter and this will continue the costly trend for families already struggling due to inflation. (ZeroHedge)

More:

- Nuclear is Back: An Analysis of the Nuclear Industry (Finmasters)

- Germany's (and Europe's) Self-Inflicted Upcoming Energy Crunch (Mises)

- The EPA Doesn't Like YouTuber's Diesel Engine Tesla (Motherboard)

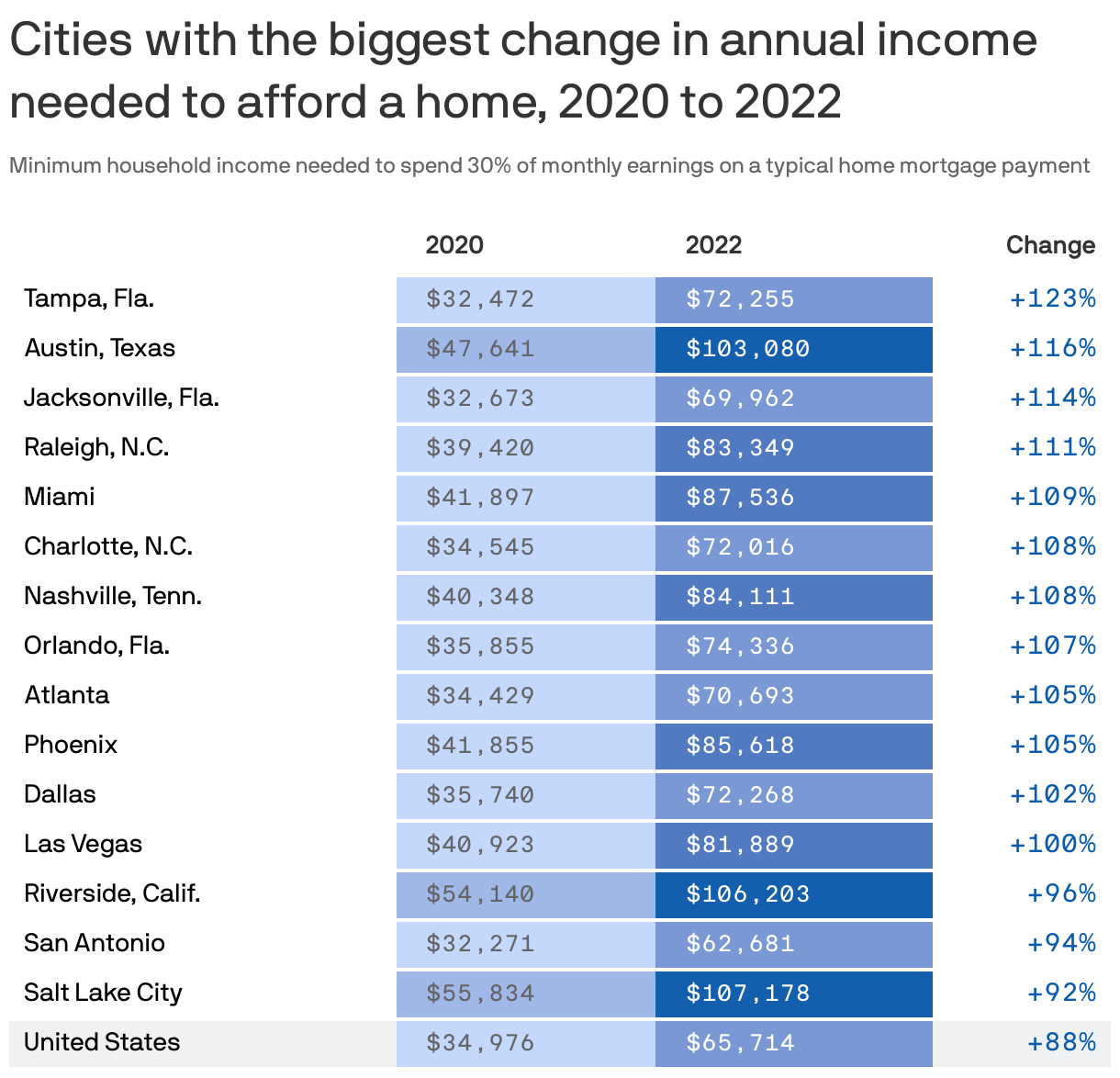

Income Needed to Buy House Doubled Since 2020

The largest changes in minimum household income needed to afford a home now, by city, according to Zillow data.

10 U.S. cities where housing markets are cooling the fastest

Details at CNBC & full report at Redfin.

More:

- Americans Paying 15% More on Mortgage Payments Compared to Last Month as Rates Surge (Forbes)

- Inflation-Adjusted House Prices Declined Further in July (Calculated Risk)

- Almost 1,000 mortgage deals pulled as panic grips UK housing market (The Guardian)

- Homeowners See Slower Equity Gains as Housing Market Cools (U.S. News)

Someone Borrowed $1.3M in ETH Using 2 'Mutant Ape' NFTs as Collateral to Buy a 3rd Mutant Ape

A 3-person company called Fragment and self-described as “creating rich stories and worlds for the metaverse,” took on a 1,000 ETH loan (about $1.3M USD) as leverage to acquire "Mega Noise" (shown below), "one of the rarest NFTs in the Mutant Ape Yacht Club collection." The collateral is two other Mutant Apes.

The lenders are Nexo and Meta4 NFT Lending. The loan repayment terms: 1,044 ETH in 90 days at 18% APY.

Details @ Decrypt & The Defiant

More:

- Cryptocurrency as Money—Store of Value or Medium of Exchange? (Mises)

- Crypto World on Edge After String of Hacks (NY Times)

- U.S. Senator: Bitcoin Is ‘Comforting’ And ‘Can’t Be Stopped’ (Bitcoinist)

- Only 30% of millennials comfortable investing in crypto, down from 50% in 2021 (CNBC)

Comments ()